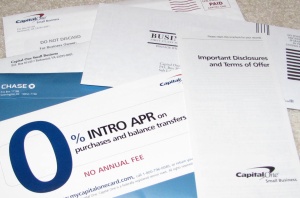

1. If you're like me, you get zillions of unrequested offers for credit cards. I thought these just wasted my time (I've got to open them, sort generic parts from those with my name, and then shred the parts with my name). But they are a big credit fraud risk. If the applications are stolen from your mail box, or delivered to the wrong address (never happens right?), you could be in big trouble. The best thing to do is to stop all unsolicited offers of pre-approved credit cards.

You can call 1-888-567-8688 to stop the mailing of these. (Don't take my advice on the number. A less scrupulous blogger could give you a phone number to call and get your ssn). Check out the phone number here at a .gov site, www.ftc.gov

2. The other big thing to do is check you credit report at www.annualcreditreport.com. Only try this site. A lot of sites disguise themselves as this one and only real site to get you to buy a fraud detection service and other products. Here again don't just trust me for the web address look at a good .gov site for the address, http://www.ftc.gov. You can get a copy from each credit agency once a year. So every four months you can check to make sure no one has opened a new credit card account in your name. Be care at their sites, because they will try to upsell you on various products. Be firm, only get your credit report, not your credit score, or credit monitoring.

3. It's also good to stop junk mail at www.dmachoice.org website. This reduces the times your personal details travel around the universe of companies trading/selling your data.

4. While your at it, opt out of sales calls at www.donotcall.gov/

Eternal vigilance is the price of good credit. Perhaps Congress should take note?

No comments:

Post a Comment